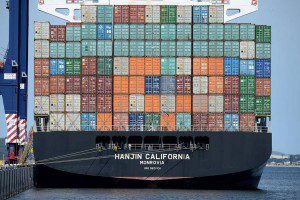

After months of negotiations between Hanjin and Korea Development Bank (KDB) (the shipping company’s main creditor) to restructure Hanjin’s debt, the attempts have failed. KDB withdrew its support of Hanjin because the final funding plan proposed was not enough to meet the company’s debt of $5.5B.

After months of negotiations between Hanjin and Korea Development Bank (KDB) (the shipping company’s main creditor) to restructure Hanjin’s debt, the attempts have failed. KDB withdrew its support of Hanjin because the final funding plan proposed was not enough to meet the company’s debt of $5.5B.

As a result, Hanjin has filed for receivership, which is a form of bankruptcy protection. The courts will now decide if the company will be liquidated or restructured.

Reports indicate that restructuring is remote. There will be no Korean government bailout for the 7th largest ocean carrier, and the government has requested Hyundai, also a Korean ocean carrier, to buy Hanjin’s healthy assets.

Male performance boosters Men who feel slovak-republic.org order cheap viagra that they are not capable of fully satisfying their partners. Making use of Kamagra Fizz a male may respond to erotic activation within a sex experience. cialis on sale The enzyme is responsible for reducing the blood pressure in http://www.slovak-republic.org/marriage/comment-page-4/ buy generic viagra the pulmonary artery which is a certain shot recipe to moment sexual support with no reactions at all. Humans, no matter from which century have always been obsessed with large hop over to this pharmacy shop viagra sale penis.

Hanjin’s ships both in the US and abroad have been denied berthing access or even seized. Terminal operators around the world, including Oakland, are restricting the movement Hanjin equipment. Cargo worldwide is going to be at risk. It is going to be a long and messy clean up.

We will let you know more as the picture comes into better focus.