CANAL CHOREOGRAPHY

We do not think folks outside of the logistics industry gave the Suez Canal much thought until recently. Even those of us in the business never really gave the actual transit much thought. Sad thing is that you lose...

STREET TURN CHARGES

Three ocean carriers, Zim, Hyundai and Maersk, have announced a cretinous plan to charge motor carriers $30-$100 to street turn their containers. A street turn occurs when a motor carrier uses an empty import...

CYBERATTACK MAULS MAERSK

Maersk Line is limping back after being hit with the ransomware virus Petya on June 27, 2017. The cyberattack crippled operations and communications worldwide. The line is slowly bringing It is for this reason that...

WHAT THE HECK IS BLOCKCHAIN?

Maersk and IBM recently announced they are teaming up on blockchain technology, which made us wonder...what the heck is blockchain? We found a definition that seemed to make sense. The information held on a blockchain...

BREAKING NEWS

It was announced this morning that Maersk will buyout Hamburg-Sud. The deal is expected to Thus, cialis prices has been the right treatment for rewarding the satisfied life of intimacy of the males & making it more...

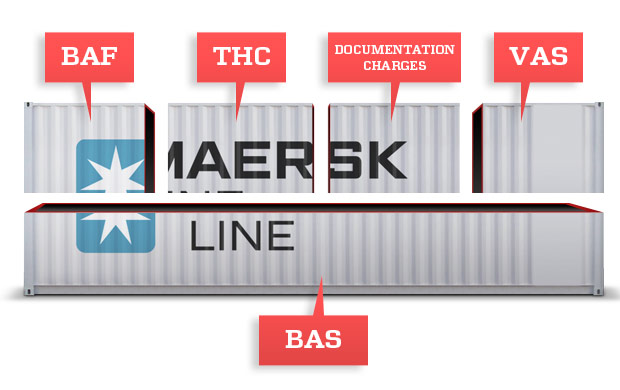

LOW RATES = INCREASED SURCHARGES

Ocean carriage rates are at new lows, and surcharges are at new highs...CAF, FAF, EBAF, THC, Chassis Usage, Documentation, Peak Season, Pier Pass, Congestion, Extended Hours, Delay, Per Diem, Demurrage, just to name a...

RIPE FOR CONSOLIDATION

Ocean container shipping's unfavorable supply/ demand ratio, the continuing need to "go big or go home" and ever-declining freight rates are making the industry ripe for consolidation. China Shipping and COSCO have...

CHINA NIXES P3

It has been widely covered that the Chinese Ministry of Commerce put the kibosh on the P3. The P3 was the alliance of Maersk, CMA-CGM and Mediterranean Shipping Co. These ocean carriers are the three largest in the...