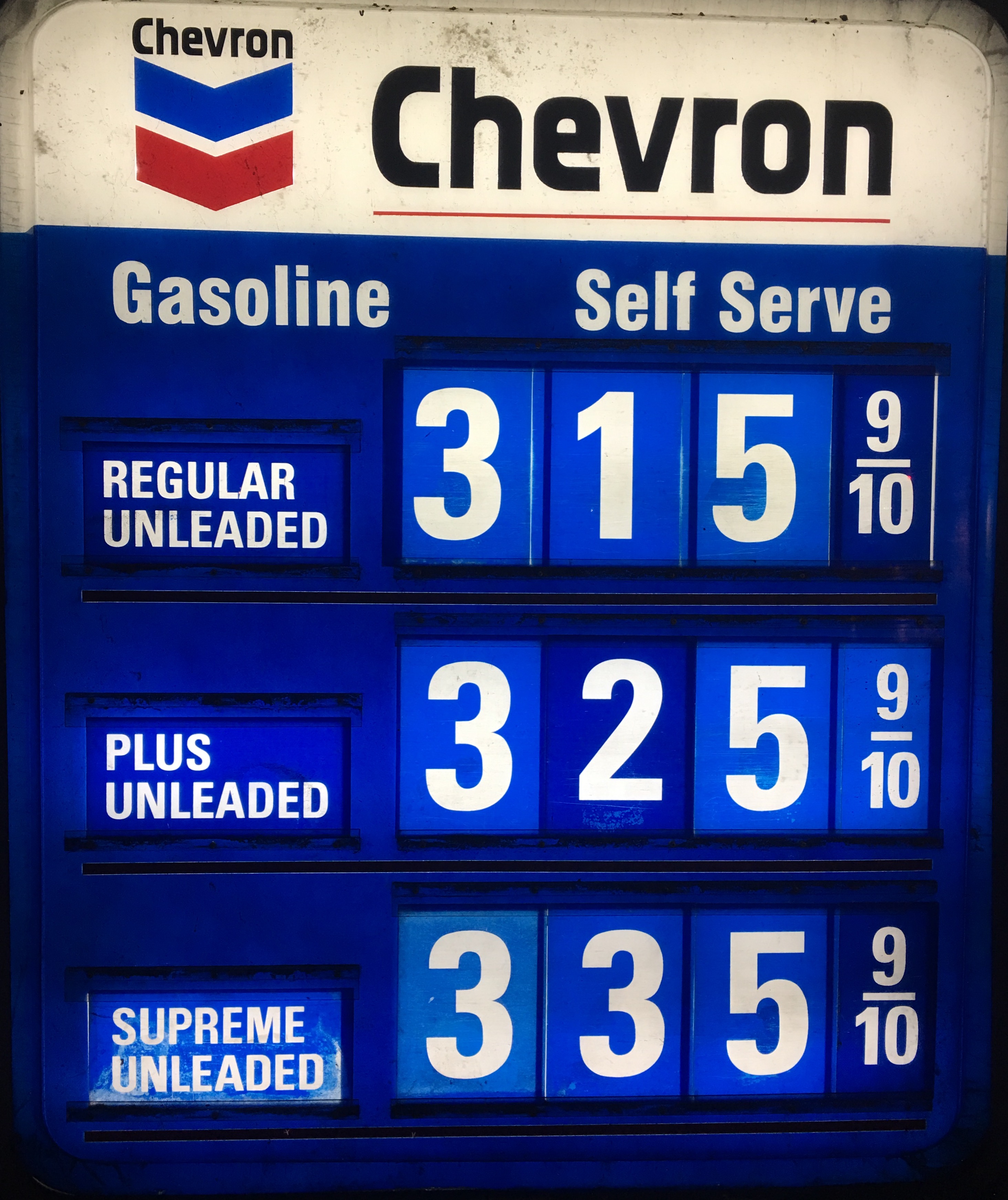

The above two photos were taken one day apart at a nearby gas station. The photo on the left depicts fuel prices yesterday, October 31st, and the one on the right is today's, November 1st, fuel prices. Why the steep...

CALIFORNIA FUEL TAXES JUMP

read more